Optimize your plans with our proprietary tool

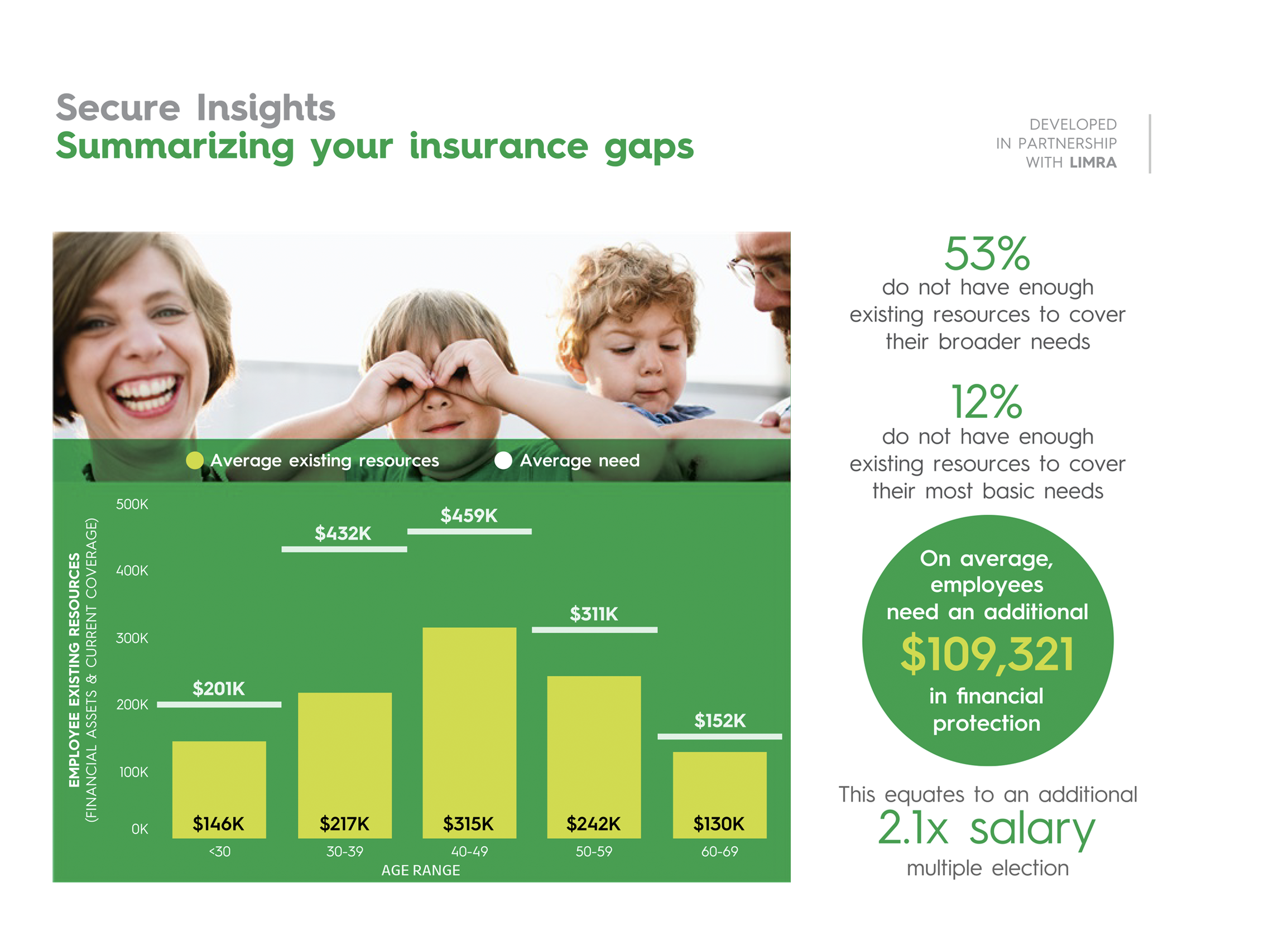

Secure Insights is our proprietary, multi-faceted data analytics solution developed in partnership with LIMRA for group insurance clients.

The tool leverages LIMRA industry data, third-party data and client census data to develop a report that provides employers a deeper understanding of their population, their populations’ needs, and the products and services we offer.

Secure Insights provides a holistic view to identify opportunities, set goals, make decisions and execute changes to help achieve the plan’s full potential.